Bigger picture context

We haven't gone over Super Micro Computer in a while. On this past Friday, SMCI offered another great opportunity for a 0dte short and I somehow sat there watching the whole thing happen right in front of me and failed to take action.

As usual, for self-accountability, here's my recap.

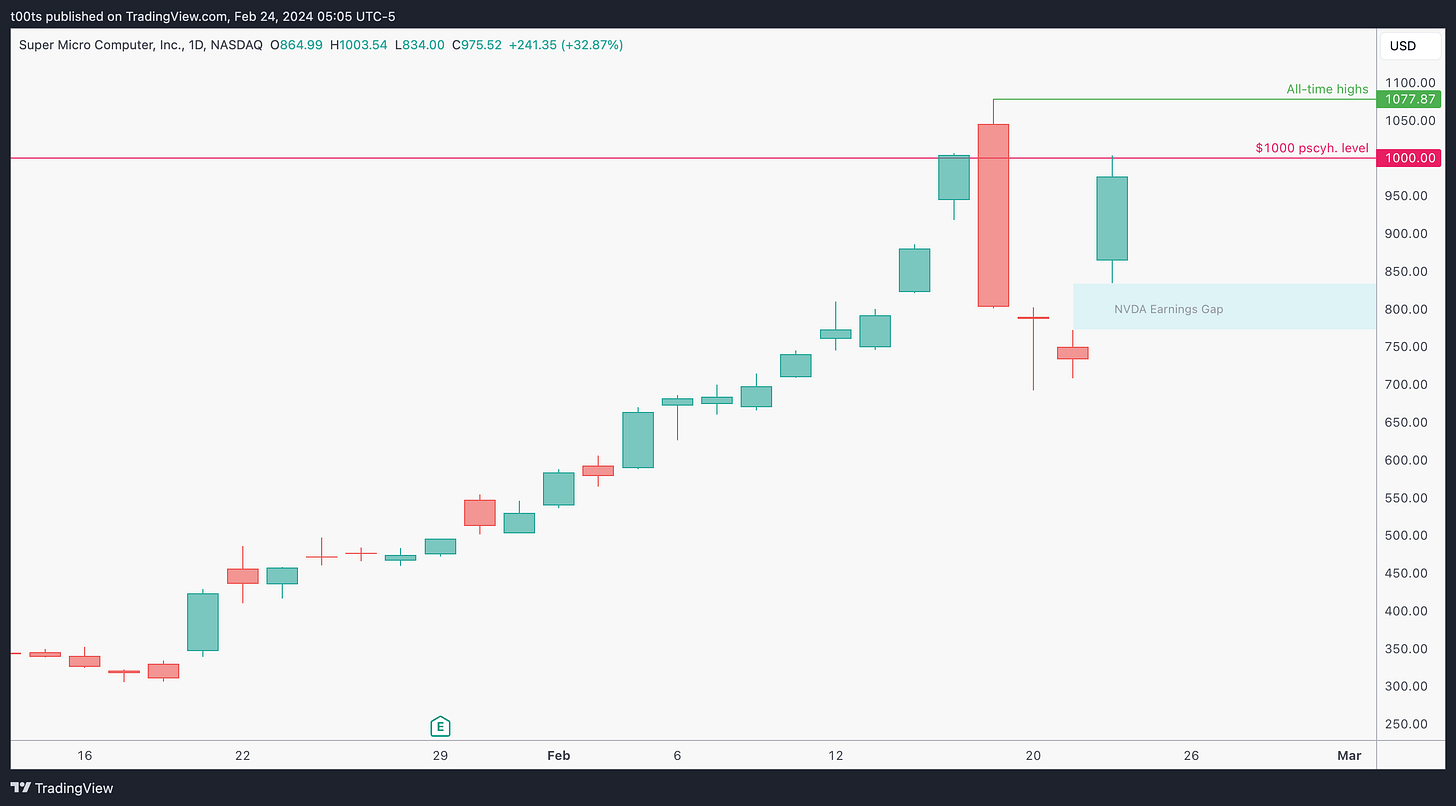

Weekly chart

After a strong bounce early in the week, price is back at the $1000 psych. mark. I've been waiting for this retest all week. There's no question this is a bullish chart, but I would argue that it's still overextended and needs a larger pullback. Let's dive in using the daily chart.

Daily chart

After that first red day with the huge shakeout, it's natural we get a mean reversion move. Add the recent NVDA earnings to the mix and we get our move back to $1000, where price could put in a potential lower high.

In my opinion, everyone who missed that first short is waiting for price to hit this area to try and short again.

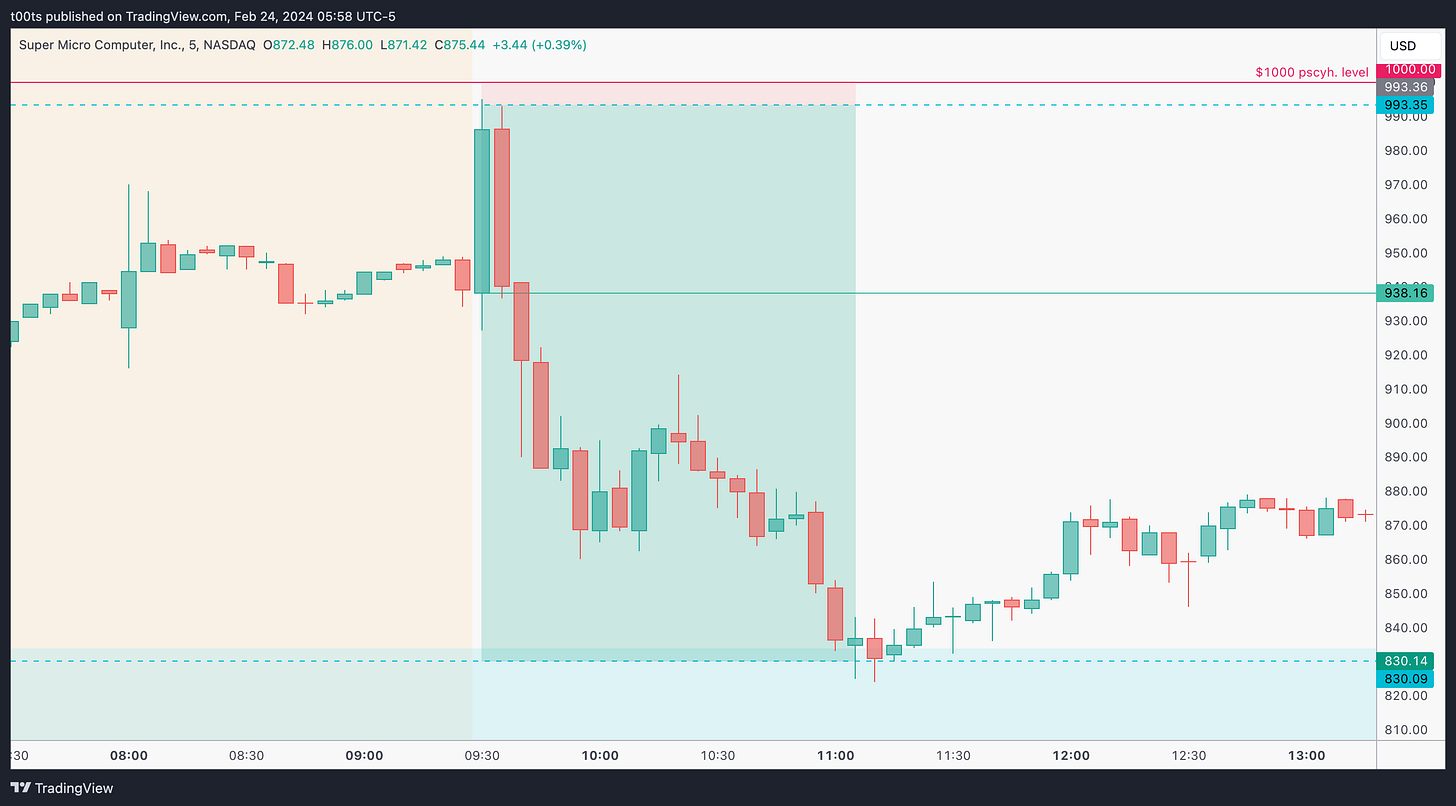

Hourly chart

Note how price rejected the $1000 right into the close, giving us our first clue and leaving us with a convenient level at $993.35 we can hopefully use the next day to trade off of. There’s over 150 points to the next level at the $830 area! If you think about it, shorting the $993.35 risking the $1000s offers a massive risk-to-reward setup.

Pre-market action

Left some room to the left so we can appreciate the magnitude of the $1000 rejection around the prev. day's close, indicating there's sellers there and we're surely interested in participating if price reaches those levels again.

The pre-market action wasn't too interesting. Price action on SMCI was a clone of its homologous NVDA, so it was worth looking at NVDA as well to gauge strength and sentiment.

The trade

I didn't really have my CPT ready, hence why I probably missed the trade. This was more or less what I had in mind:

Cue(s)

Overextended stock reverting to the mean, setting up for a larger pullback

Strong rejection at the $1000 key level on previous day

Intraday cue: Quick pop into the $993.35

Plan

The plan was to short the pop to $993.35.

I came late and unprepared to my desk, and missed the moment price rejected. So the new plan was to look for a quick pullback on the 2 minute chart on the way down and get involved there, but the rejection was so aggressive we never got any pullback.

Price just blasted back down through the opening print and there was no way I could justify jumping into 0dte puts by then. I guess if you trade the stock itself there's a chance you could've caught this.

Trigger(s)

The slightest rejection at $993.35, allowing for a stop at $1000

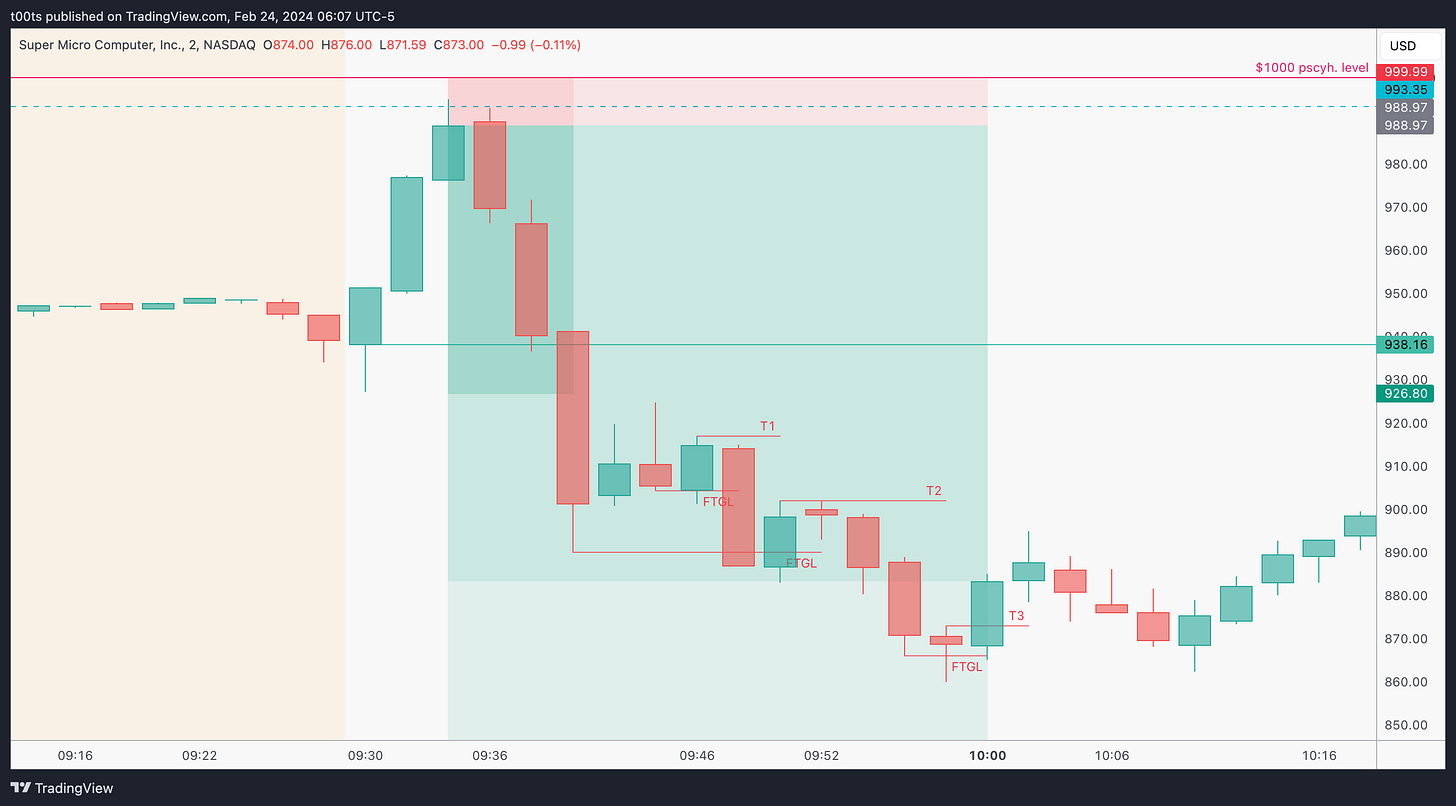

2m chart

Notice how quick and strong the rejection was. Price literally dropped $100 points in 6 minutes (read that again). A true blessing for anyone who caught the short.

Just that first red 2m bar had a 25 point range. While the risk-to-reward if we're targeting that lower $830.09 level was still acceptable, when you're using 0dte options as trading vehicle you're inevitably putting yourself in a risky position at this point. That's why I just had to sit there and watch it melt.

The key here was trading the rejection, just as we do often with bounces. Same scenario, opposite side.

The moment price breaks the low of the day is a great place to start trimming. You've captured anywhere between 60 and 70pts in a quick reversal. The weekly 850 puts were going nuts on that delta flip.

I've marked the stop trails for the remaining position. All of them are set based on failure patterns, but only T3 triggers. I wasn't watching anymore at this point so not sure if those extra 30pts were worth the hold with 0dte options.

5m chart

Leaving a 5m chart for reference, as price did hit the $830.09 we discussed earlier, leaving stock day traders with a potential 24R trade.

Closing notes

Not a great week for me honestly. Didn't even feel like reviewing today… Yet even if it's not the best review, it's just good to get it done. I'm not sure what I could've done better here besides being prepared. As much as I look at the chart, there's no way I'd chase this. It just moved too quick and I wasn't ready to trade shares on it.

As the saying goes, luck is when preparation meets opportunity. I wasn't prepared. There's a learning there.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!

👏🏼👏🏼👏🏼