NVIDIA (NVDA) - Feb 22nd 2024

The obvious post-earnings trade worked, but was not an easy hold

Bigger picture context

NVIDIA's much awaited earnings are finally out. They beat on all fronts, guided higher and clearly stated that while they’ve improved their supply, demand still far exceeds it.

Stock added a record-breaking $250 billion market cap increment just this day. For context, AMD's market cap is currently sitting at $293 billion. Crazy times we live in.

Nevertheless, NVDA presented a post-ER setup we've seen before. Let's go over it.

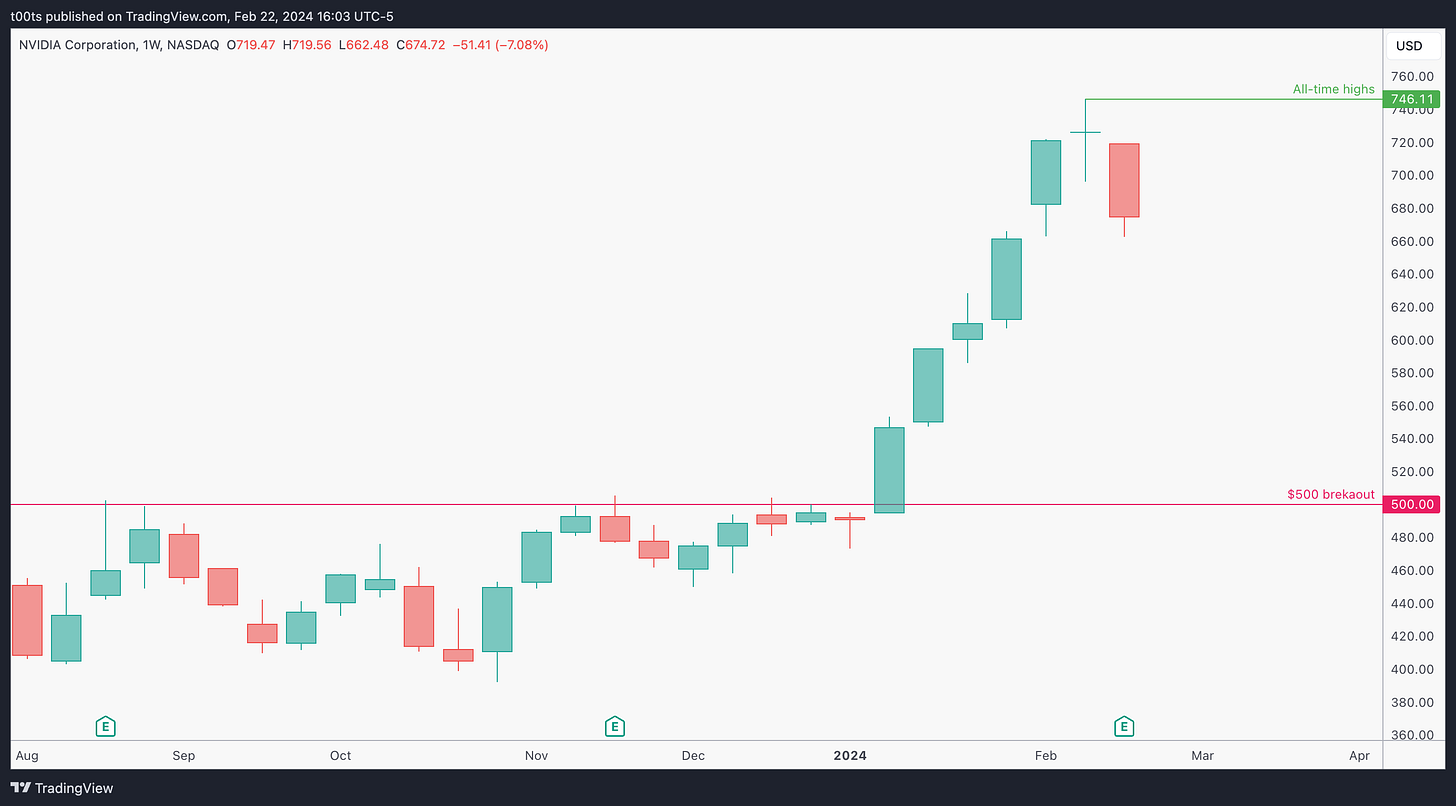

Weekly chart

This weekly chart was still in formation at the time of this snapshot. However, we can see price has finally found some rest after its +50% rally since the $500 breakout. Good and healthy sign. Irrelevant ahead of such an anticipated earnings release, but healthy regardless especially if we want to keep going.

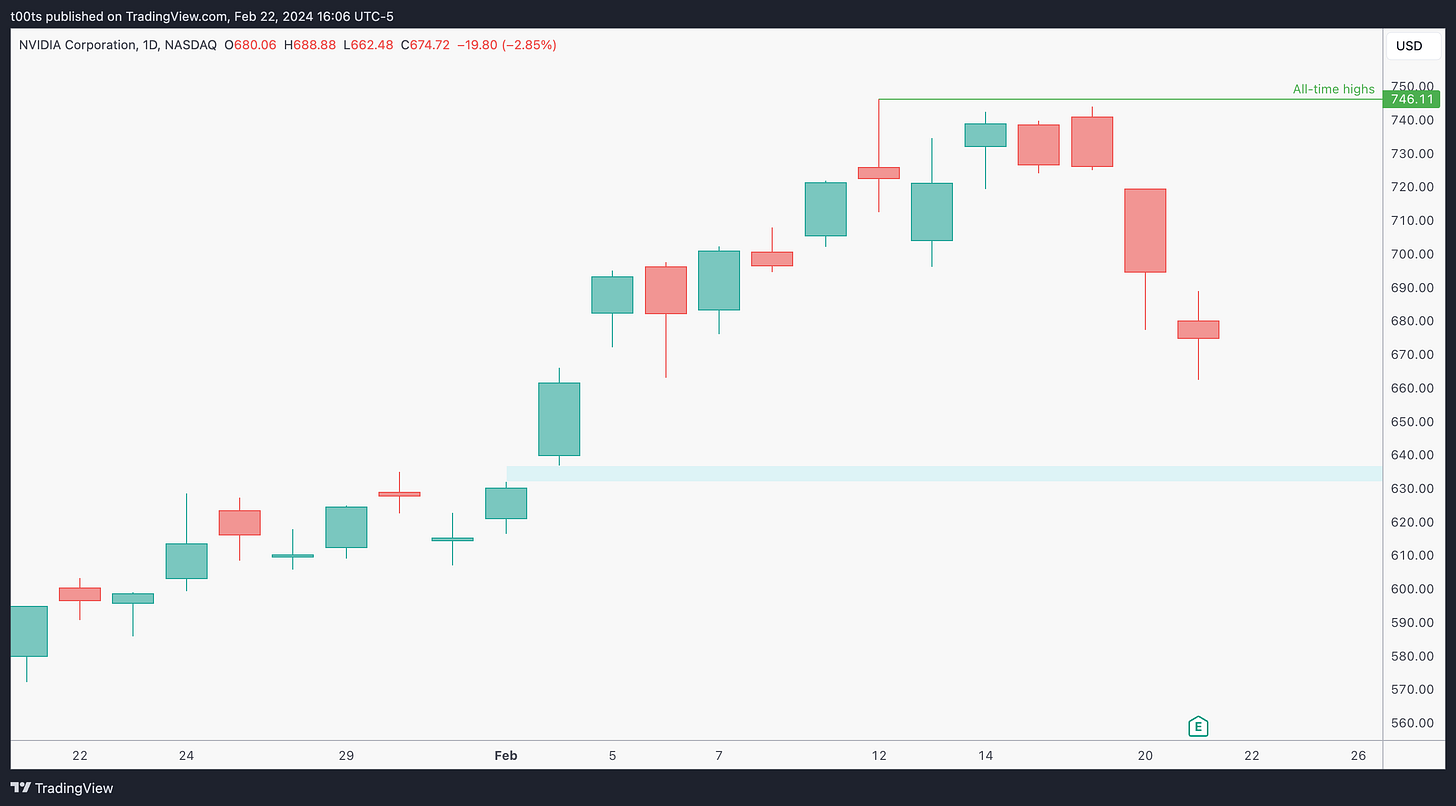

Daily chart

On this daily chart we get a closer look on this pullback. This retracement accounts for roughly a 10% decline off the highs. Nothing too concerning.

Hourly chart

This hourly chart will be somewhat irrelevant as the stock is going to gap up above all-time highs on their earnings beat. Regardless, it's interesting to note that distribution at the $700s. I bet there's many players who offloaded risk into the announcement and many others who are sitting short and excited about this pullback, hoping for further extension to the downside.

Pre-market action

There's no doubt there was a lot of attention in this name at this point. An arguably extended stock was gapping up above previous all-time highs.

It's worth pointing out how price had lost momentum and had been pulling back throughout most of the pre-market session, however, those previous all-time highs are still holding and thus very much in-play for the open.

The trade

Once again, we've seen this setup before. It's exactly the same playbook as this PANW long we went over a few weeks ago.

So, this CPT should be pretty obvious and not surprise anyone:

Cue(s)

Market leading stock in strongest sector

Well rested after much-needed multi-day consolidation

Earnings beat on all fronts and solid forward guidance

Gapping up above all-time highs and 3 red days

Intraday cue: Prev. all-time highs hold the open

Plan

First things first: We're only interested in longs. There's no such thing as overextended Get that out of your head/body/soul/ego. The trend is bullish and this is the strongest stock in the market.

Just as with PANW, we're interested in watching reactions at the previous all-time high mark of $746.11. We have the $740 area right below which corresponds to the upper bound of the multi-day range we saw on the hourly chart, so we'd expect that to hold for price to continue climbing.

While we are looking for an opening drive play, we need to be ready for a potential slow open that then picks up later. Just a quick mental check-in.

Whatever we do, we're risking the low of the day. We can't wait and hold to see if the $740s hold. We get out first, and then get back in if needed. Our target is the $765 level which acted as both support and resistance during the pre-market, and then the pre-market highs.

Trigger(s)

Price trading below previous all-time highs and reclaiming them.

Price reclaiming the opening print.

2m chart

To be fair, the first entry gets stopped out on that second dip. Some people like to wait a couple minutes before taking an entry. I often don't, but I think that's a great idea honestly. Regardless, on that second 2 minute bar, price quickly bounced back up above those previous all-time highs. If you were watching this, chances are you got a better price than the one marked on the chart, but again, we like keeping things as systematic as possible in here.

This trade was not an easy hold with weekly options. IV was settling down but still very high, thus the premiums were very volatile and price action was choppy. At multiple points during the climb it seemed like we were going to fade back down. As I've said before, to avoid making dumb decisions it's a great practice to zoom out. But also, letting bars close. Most of these 2 minute bars were red at multiple points while they were forming, yet most closed green.

The breakout of the $765 was the final push we needed to squeeze those premiums and sell into strength. Holding runners wasn't an option in my opinion, as these contracts were 1 day away from expiration and the IV crush as the stock's volatility settled would further decrease their value.

Closing notes

These trades seem fairly straightforward when reviewed like this. Everything looks great and easy. But it's not. Taking these trades in real-time requires a lot of practice and being at your top mental game.

Mistakes are common in this game, and more often than not lead to emotional buildup that, if not managed, will lead to further mistakes. It's very hard to stay on top of your A-game consistently. The only thing that can protect you from yourself is a well-defined edge, but sometimes we just divert from it. That’s where Floaty, the first personal assistant for retail traders, soon to be released, will provide the ultimate add-on to your toolbox.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!