PayPal (PYPL) - Feb 26th 2024

Stock's resilience despite negative catalysts opens the door for potential longs

Bigger picture context

Everyone remembers when PayPal CEO said they would shock the world. We went over the trade leading into the announcement.

For context, the announcement itself was frankly underwhelming. They announced faster checkout processes, a complete overhaul to their mobile app, and of course, some AI-powered [useless] features. PayPal stock sold off after the event.

A few weeks after the announcement they had their Q4 earnings release, and although they did beat analyst estimates, their forward year guidance fell short of expectations, leading to an 8% slide in the after-hours trading.

Despite these bumpy weeks, stock has been holding surprisingly well. Let's take a look.

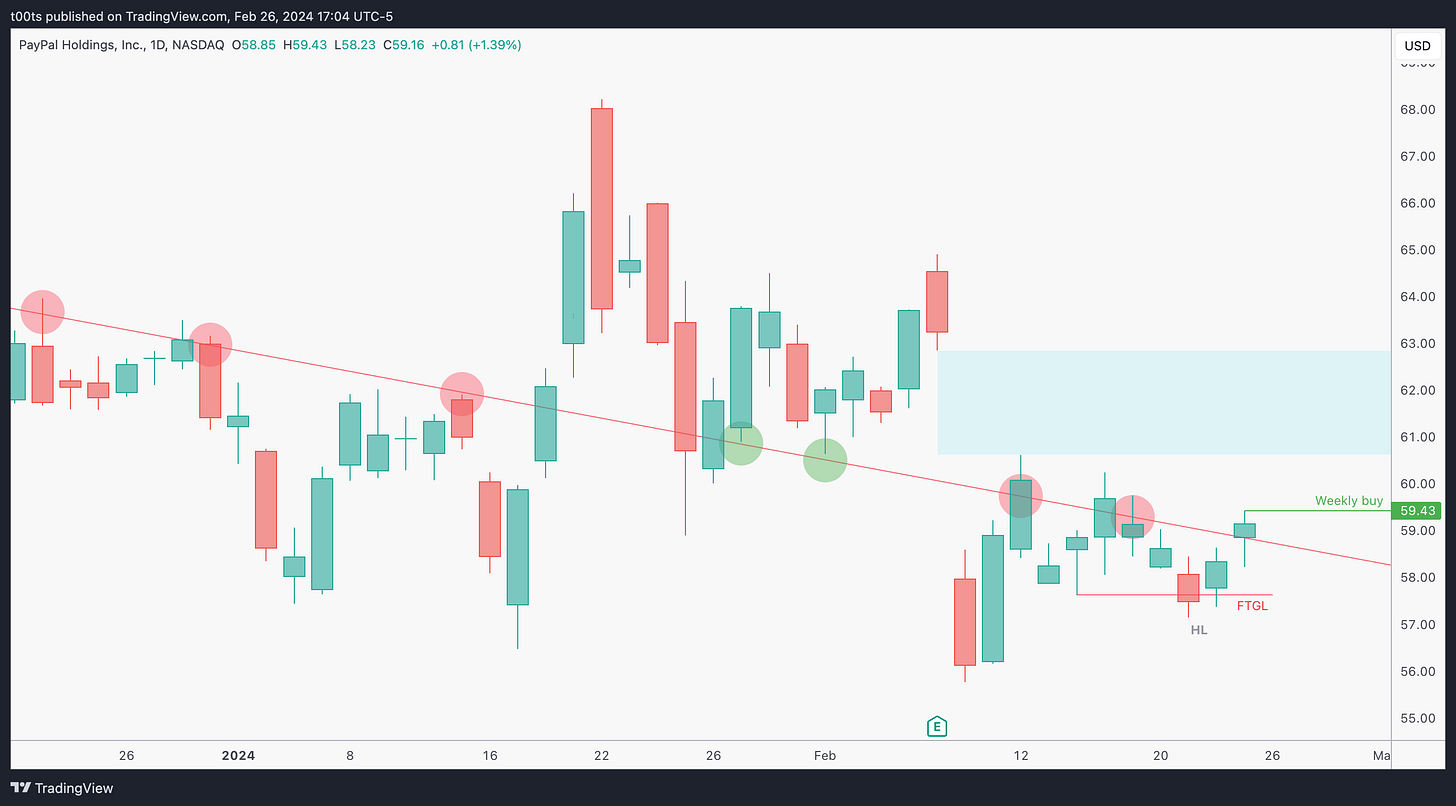

Weekly chart

Notice how price broke out of that trendline heading into the announcement, came back down once the news was out to retest it, held there for a week, and then sellers took over on that weak guidance and pushed the stock price back below the trendline.

At this point, you'd expect price to continue lower, as all the longs who bought the breakout are now trapped. Yet price is holding. I found this hold very interesting, and lead me to believe there was upside potential as price settled on this potential higher low.

Daily chart

We can appreciate the action around the flopped announcement with greater detail. Notice how bulls tried to hold the trendline twice after the sell-off. They were doing a reasonably good job until the earnings release truncated their efforts and brought the stock below the trendline once again.

Despite the gap down, buyers quickly bought the stock back up. It's only been two weeks and they've already had multiple attempts to break back above the trendline. It surely seems as we're not going any lower.

Hourly chart

The hourly chart displays a healthy uptrend since that failure to go lower. Price spent that last session consolidating so there's potential to break out and keep going. The $60 mark is the strongest level as it corresponds to the start of the previous down swing.

Pre-market action

Pre-market action was irrelevant to this trade.

The trade

An unconventional trade for what we're used to here, but solid regardless. Kept my CPT pretty simple on this one, let's go over it:

Cue(s)

Weekly chart holding well after flopped CEO announcement and rough earnings

Daily chart showing buyers in control as they attempt a new trendline breakout

Unfilled daily gap above

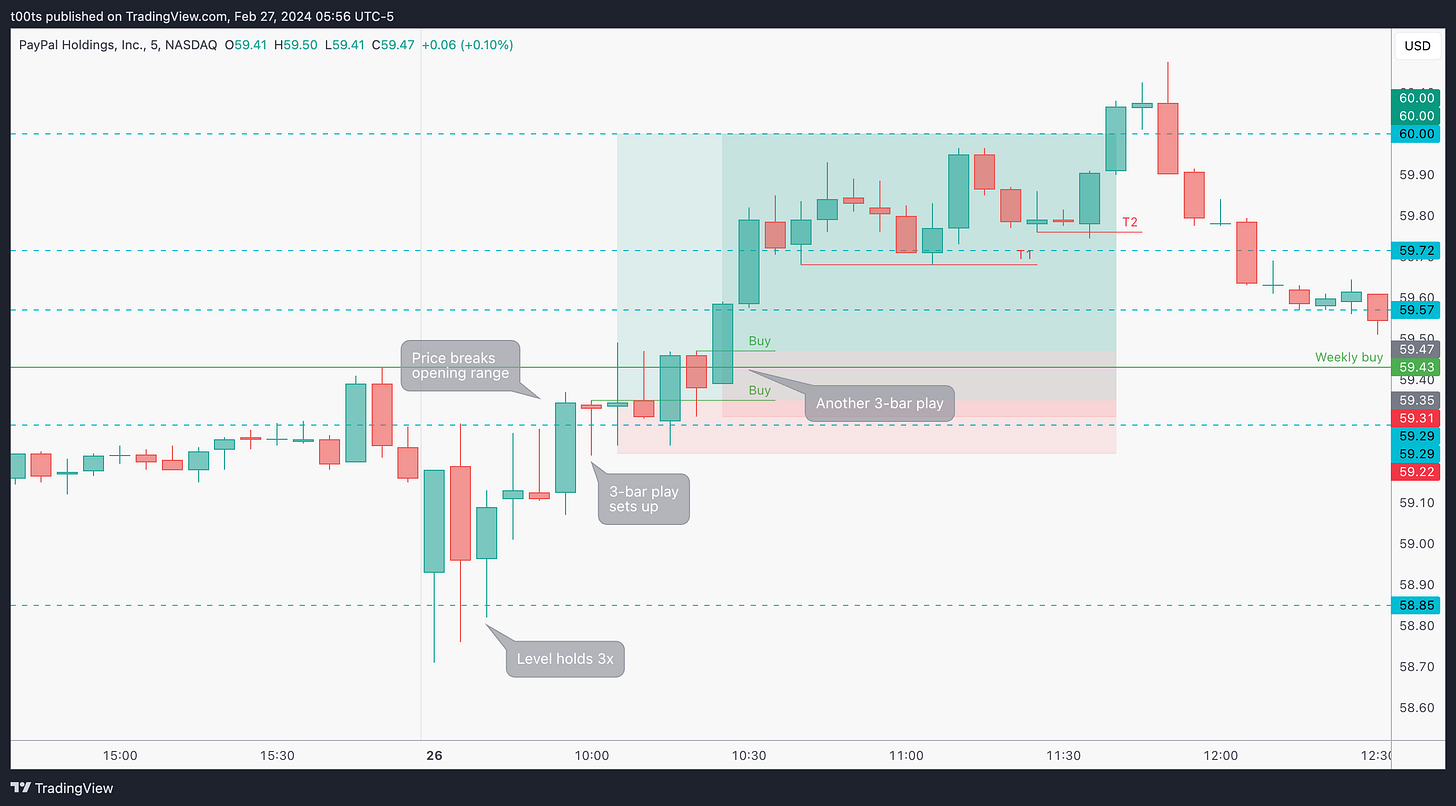

Intraday cue: 3-bar play at a level after breaking the opening range

Plan

The plan was to try and participate on that weekly buy breakout. Price was in a range all morning, but near 10am it breaks the $59.29 with a strong bull bar and the moment it starts pulling back a 3-bar play seems possible.

Trigger

Ideally, the 3-bar play triggering, although I did start my position slightly before the actual breakout.

5m chart

Price started the day trapped between two levels. One thing was clear though: That $58.85 kept holding every time it was tested, even putting in higher lows on each bar. Eventually, near 10am price breaks the opening range with a clean bull trend bar and sets up a 3-bar play right at the $59.29 level. I start accumulating at this area with the conviction that we're setting up for a weekly buy trigger. While it does take a little bit of time to materialize, we finally get the breakout. In the meantime, note that the stop loss never triggers.

The moment we break out, there's another 3-bar play forming at the weekly buy mark which allows for yet another entry and plays out immediately, resulting in a stress-free add to our existing trade.

Price starts consolidating around the $59.72 level. It then fails to climb higher, but T1 is never triggered, so there was no reason to get out just yet. A little bit later, T2does trigger ever so slightly. I cut my size here but it didn't seem like we were going to reverse, price was just chopping around on low liquidity.

The wait proved profitable as we would then get the last push into our final $60 target level.

Closing notes

There were better plays on this day, trust me. For some reason I went with this name and managed to do well on it. The weekly chart looked ready to take off, but it didn’t last long as the stock gave back most of its gains towards the second half of the day.

I started the trade with the idea of swinging into the gap fill. Luckily I decided to take everything off as we got the 60 strike calls in-the-money. The pullback after that was quite nasty, I surely wasn't expecting something like that at all. This reminded me that while edge, screen time, and mental game are important, luck can often play a significant role too.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!