Meta Platforms (META) - Feb 2nd 2024

Stock market's greatest plunge turns into a massive comeback

Higher timeframe context

Meta announced their 2023 Q4 earnings and beat analyst expectations on all fronts. The stock, which was already up a whopping 335% since it's 2022 lows, managed to gap up another 16% after the announcement and close the day with a 20% gain with respect to it's previous closing price.

Anyone who's been reading some of my posts knows that I've missed pretty much the whole thing. I've never understood what was driving this completely bizarre V-shaped recovery. I've finally capitulated on being passive about this situation. Dug into it a little bit and here's what I found have been the main drivers of this recovery:

First off, Meta has been laying off people and closing offices. They use other fancier terms for these “operations” but that's what it comes down to. They're currently 22% leaner than one year ago. That's a substantial cut, and investors love this. Especially when you take into account they actually increased their revenue by 16%, which translates into substantial increases in operating income and profits. It's now a leaner company and it's operating more efficiently. What else could you ask for?

Another notable highlight was that they are initiating a dividend of 50c per share for shareholders. This is the first time ever Facebook’s parent offers dividends to shareholders. Zuckerberg is actually the largest shareholder, owning somewhere around 15% of the company. He's expected to get around $700M/year in dividends. Fair game to be honest, especially considering his $1/year salary (with no bonuses).

They also announced (yet) another $50b increase in stock buyback. Investors love that, for obvious reasons. A company that bets so hard on itself offers an added confidence boost to anyone who owns it.

Of course, we can't ignore the world-leading theme of Artificial Intelligence. They announced long-term plans to increase their investments in AI infrastructure to support their products, Zuck himself said they'd double down on plans to introduce generative AI to their platforms, following the lead of Microsoft and Google. They are apparently working on AI assistants for users, content creators and advertisers across their multiple platforms, as well as leveraging AI to increase advertising performance.

Just for the sake of completeness, their metaverse venture Reality Labs is still losing money. It's actually worse than previous years, but that doesn't seem to worry investors anymore given how the rest of the company is doing.

Weekly chart

I frankly don't know how to even describe this weekly chart. I'll leave it up to the reader. All I will point out is how the $400 psych. level has acted as a magnet after the stock recently made new all-time highs. Price is sitting right below it heading into the earnings report.

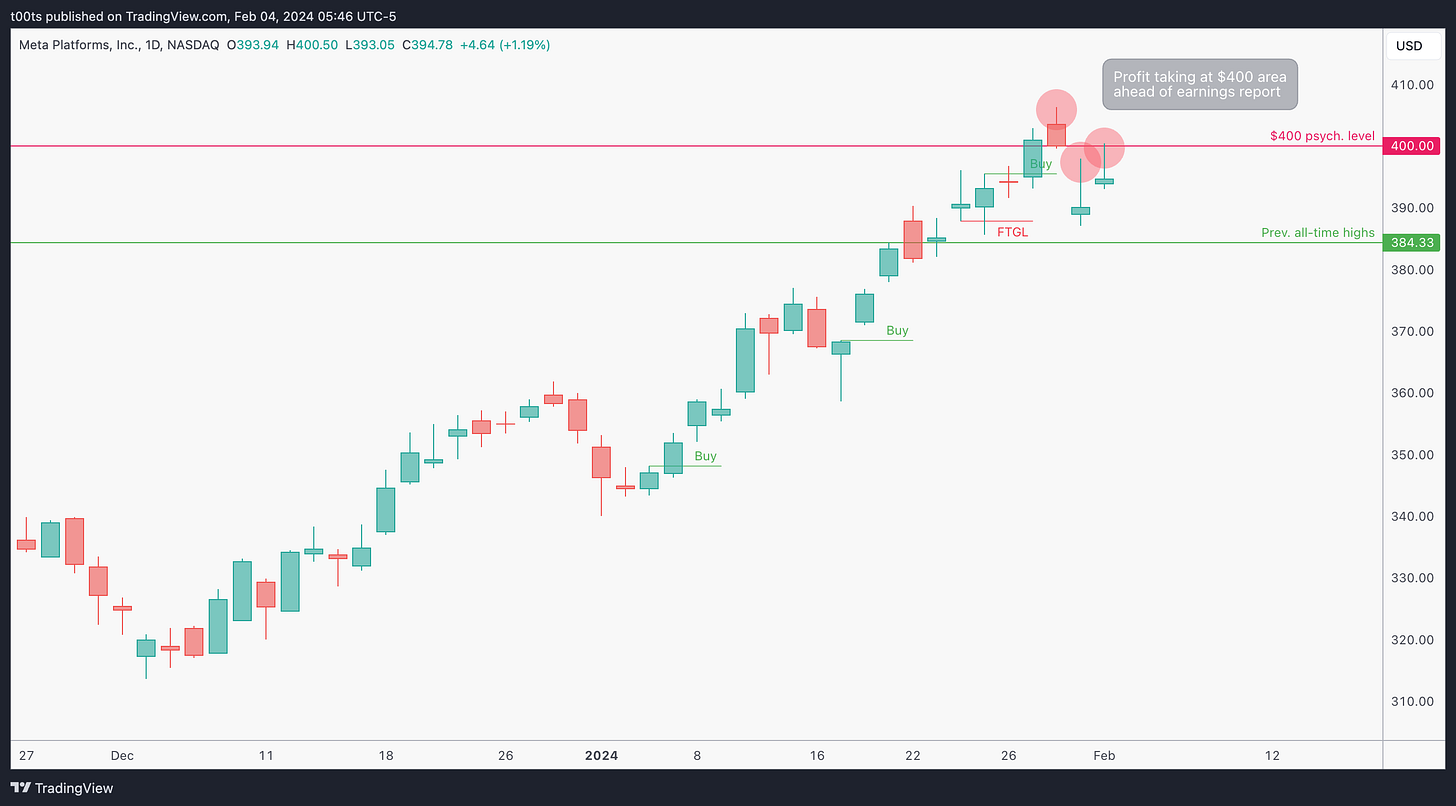

Daily chart

Investors have been collecting profits around this $400 area as they offload risk on an arguably overextended stock which is headed into the uncertainty of an earnings announcement.

Hourly chart

This hourly chart is somewhat pointless as we already know that the stock will gap up 16% after the announcement, but nonetheless, judging by the price action, I wouldn't be surprised that there were a bunch of shorts piling on on that $400 retest marked with a red circle.

Pre-market action

As with most post-earnings plays, here's where we'll get the most information. Especially if the stock is breaking out into unvisited territory. Just like we saw with SMCI, we can use round number psych. levels and any other clues price gives us as references to trade off of.

What stands out here is how the $450 level beautifully holds in the after hours. The stock gaps up the next day and although it looses some steam towards the open, the opening gap holds.

The trade

The ideal scenario here is to see a quick drop to $450 and watch for a bounce there. The drop would be justified as investors take profits after the outsized move up in the overnight session. And the bounce is likely given all the positive catalysts that have been announced.

Using our CPT Framework:

Cue(s)

Strong earnings beat in all fronts

Stock initiating dividends for the first time (makes it attractive for new investors)

Another $50b buyback program announced

Massive gap up into new all-time highs

Plan

Plan is to see reactions on the $450 level and take it from there. We only want longs on this name, so we're interested in buyers interest and strength after this gap up.

Trigger(s)

Price reclaiming the opening print or a higher low on the 2m timeframe.

2m chart

As usual when we're looking at opening drive plays, we zoom into the smaller timeframes.

In this chart we notice how the opening gap level holds after an initial move down. Price never gets to our $450 psych. level, as the doji formed breaks to the upside and puts in a trend bar that closes above the opening print. This is good enough for us to consider an entry.

I know a lot of traders who got in below the open on that push up above the doji. I try to keep things as systematic as possible in these posts, so we're going to put our entry on the break of the highs of the trend bar that breaks back above the open, using the open itself as our stop level.

There's no clear target as we're in price discovery mode. We just use price action to gauge the trend and trail our stops.

Our first trail is on the first 2m higher low we get after the initial move up. Nothing new here, this is how we usually trail.

Our second trail is after price fails to trade higher. We trail our stop to the lows of the failure bar and it hits immediately. This exit results in a 5R trade, and considering our entry wasn't aggressive at all that's pretty good.

Closing notes

It's amazing how Meta just became Wall Street's top comeback pick, when only two years ago they suffered the biggest wipeout in stock market history. What a ride for investors...

Congratulations to everyone who bought those lows. Bold bet that paid off.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!

Great analysis! I bought META at 129.75$, shame I sold 80% of it on the way up. What a recovery!