Arm Holdings (ARM) - Feb 26th 2024

Trading an A+ opening drive after a strong pre-market breakout

Higher timeframe context

ARM has been holding that earnings gap really well. Semiconductors are still moving and while ARM hasn't really been climbing, the sole fact that it doubled its valuation and has been holding well ever since tells us a story.

It recently had a setup that's worth going over. Let's dive in.

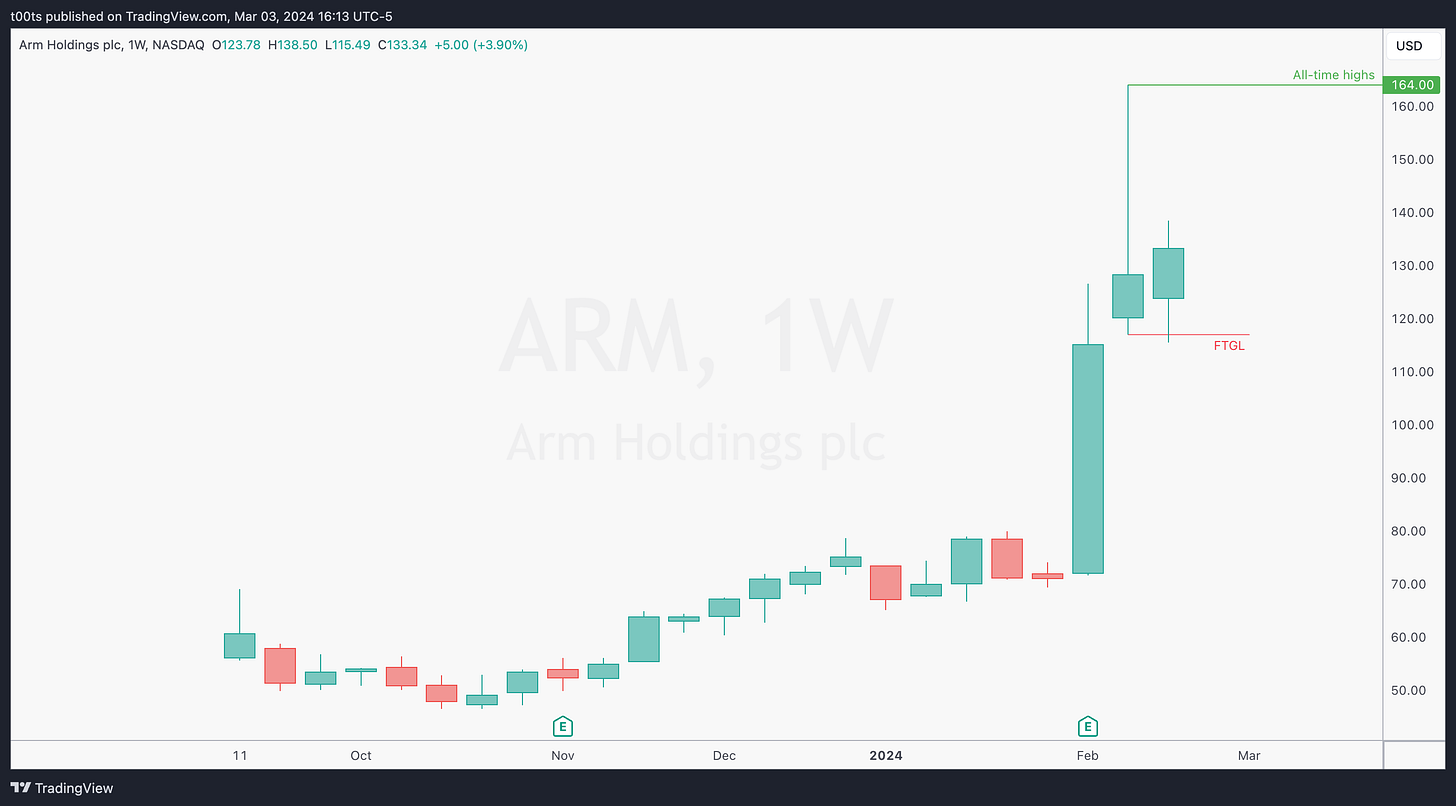

Weekly chart

A somewhat bizarre weekly chart because of that post-ER push. What's important here is how this past week held the previous week's lows. Despite that large ugly wick, buyers have managed to remain relevant and close another green week.

Daily chart

Bulls have been defending the $120 area well, effectively creating a potential higher low in the grand scheme of things. Despite the ugly chart, price is currently consolidating after the post-ER move. Still a normal sign of any healthy uptrend.

Note how that $135 area has been acting as resistance, rejecting price up to 6 times in the past two weeks. Very relevant zone.

Hourly chart

Quite some room to move above if price can break that $135 area we just mentioned. There's levels at $134.82 and $138.32 we can use to trade off of eventually if buyers make another attempt at the breakout.

Pre-market action

I left some of the action from the previous day as I found it relevant.

Notice how price struggled to break the $132.82 during the previous session. The level rejects again early in the pre-market session, but when it later breaks and retests, price shoots straight up into the $138.22 clearing the $135 area.

Minutes before the bell, the $138.22 gets cleared and price is setting up for an open above it.

The trade

Price is finally breaking above the $135 area, which has been holding bulls back for the past two weeks, and set to gap above a strong level into an area where there's plenty of room to move. This is an A+ setup we've seen before, and thus our CPT should look familiar:

Cue(s)

Stock has been holding its post-ER gap really well

Weekly failure to go lower as buyers held well after that nasty wick

Strong breakout of the $135 daily resistance in the pre-market

Gapping up above a key level with plenty of room above

Plan

Our level is pretty close to the opening price, so we'll want to see a quick retest and as soon as price reclaims the opening price, we'll want to jump in risking below the level and targeting the $150 psych. mark.

Trigger

Price reclaiming the opening print after testing the level

5m chart

The trade works really well as we get a clean entry straight off the open on that level retest and reclaim of the opening print. That 10pt push during the first 10 minutes of the session is a blessing. Our first target here was the $150 psych. level.

Although price does nearly reach the $150 later in the day, it wasn't with a lot of chop in between. Chop that most likely stopped out most of anyone's position.

In this particular case, and abiding to the rules of the system, there's a 3-bar play that forms on the 2nd and 3rd 5-minute bars, but fails after triggering the buy, trapping longs and leading to chop. The moment this pattern fails and price trades back below the signal bar, we immediately get stopped out from our trade.

While in this particular case price does hold and eventually resumes the uptrend, more often than not failed 3-bar plays mark the top of the current leg.

Closing notes

There were many interesting setups on this particular day. Despite going with PYPL myself, I felt this was one of the most straightforward setups going into the open, and thus worth our time and review.

The AI hype wave is still much alive and these names are certainly far from done. Keep them on close watch.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!