Adv. Micro Devices (AMD) - Feb 23rd 2024

When the sympathy play works better than the actual play

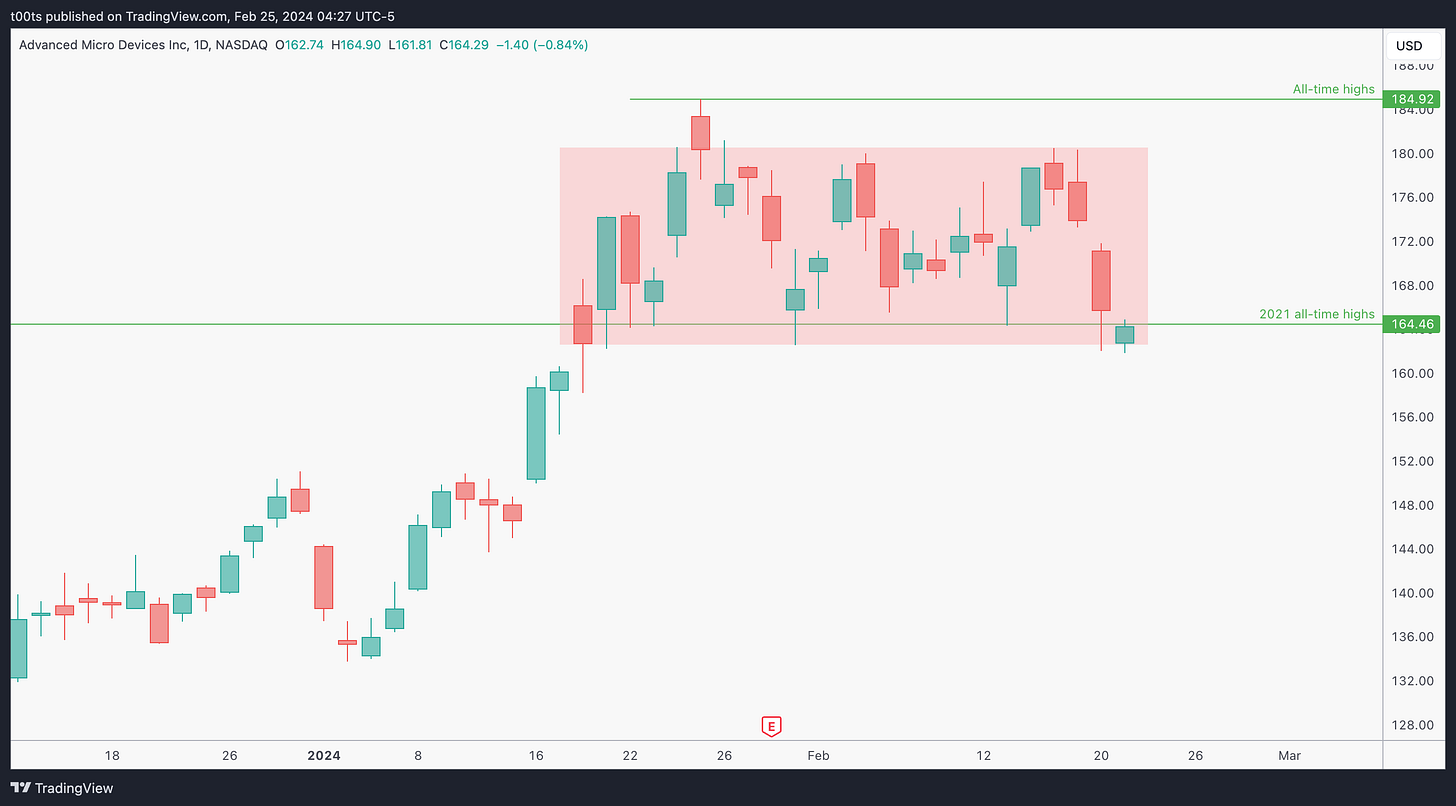

Bigger picture context

AMD made a better move off NVIDIA earnings than NVDA itself. Its stock is arguably less overextended than NVDA’s (is NVDA really extended though?) and also offers a more affordable option to get involved in the endless semiconductor frenzy.

Weekly chart

Price has been consolidating for a few weeks above those 2021 all-time highs, failing to catch as much momentum as its semiconductor peers. This is the 5th time the stock tests this support level as far as we can tell from this weekly chart. Let's zoom in.

Daily chart

We're not surprised to see price in a range. That was an interesting hold on the lower bound ahead of NVDA earnings. Very small inside bar with bulls holding the line.

Hourly chart

Not much to go over on this hourly chart as -spoiler alert- price is about to gap up off NVDA's strong earnings. Marked a few key levels for our reference later.

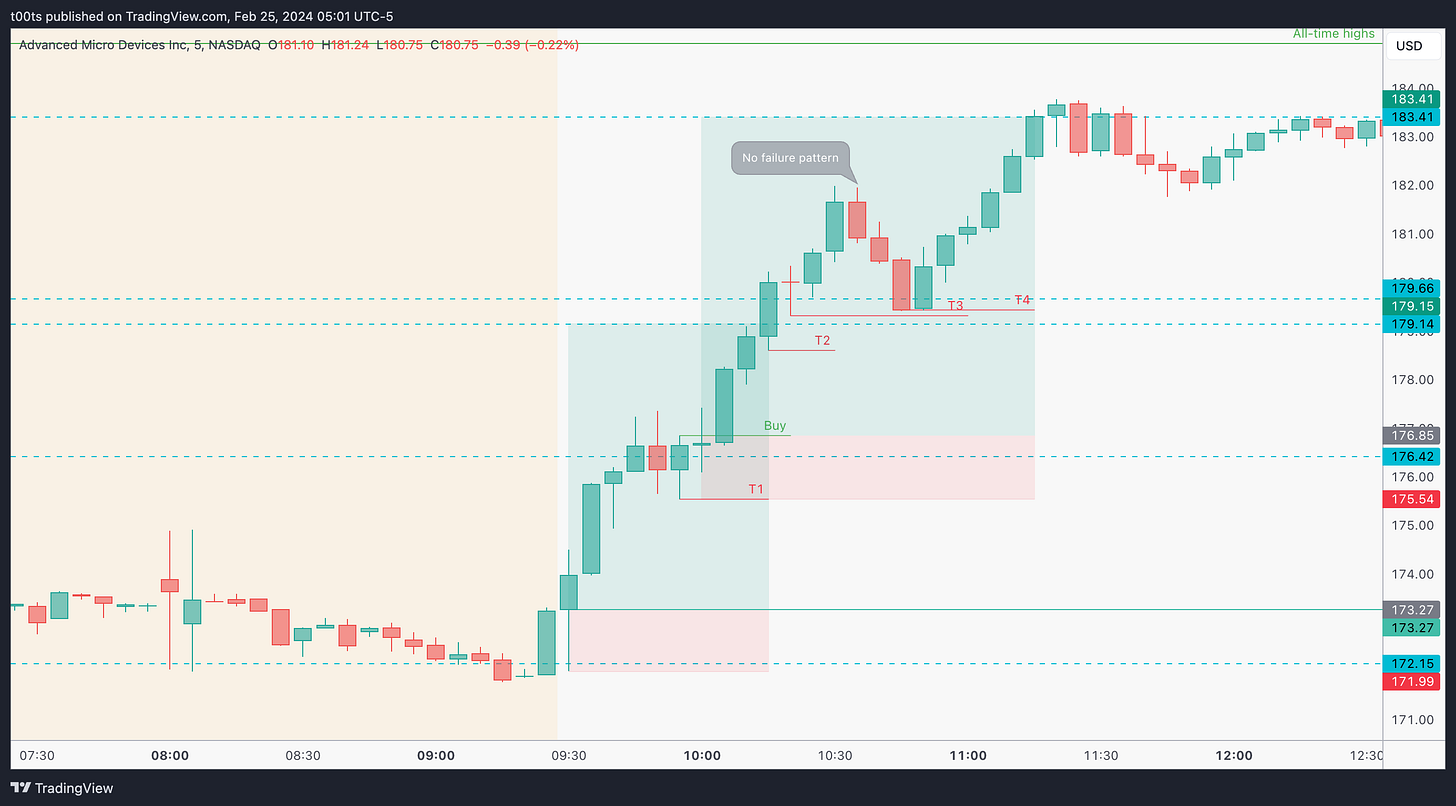

Pre-market action

As expected, here's where the action starts. Remember NVDA is gapping up above all-time highs, and although losing some momentum, it's holding ahead of the opening bell.

Not surprisingly, here we have the exact same scenario, as they are highly correlated names. AMD gaps up above the $172.15 level and mildly fades just like NVDA all the way to the open, where we get our last clear sign of bulls committed to holding that level.

The trade

Using our CPT framework:

Cue(s)

Sympathy play to NVDA's stellar earnings release

Stock is arguably less extended than NVDA and more affordable

Bouncing off lower bound of 5-week range around all-time highs

Gapping up and holding above a key level

Intraday cue: Retest and bounce off the $172.15

Plan

When a stock is gapping above a level, we want to see it retest the level and trade back above the opening print. Our stop is then set below the level and we're looking for at least two levels above as target, so we'd be targeting just below the $180 area.

Trigger

Price reclaiming the opening print after bouncing off the $172.15.

5m chart

Price does give us a bounce this time right at a level. This is honestly one of the best intraday cues you can get, especially straight off the open. When price just shoots straight up (or down) is when things get tough because you're either in it or have to tame your FOMO. Instead, when you get the bounce, buyers confirm their interest and your trade thesis becomes way more solid and it's much easier to get involved. Targeting the second level you're looking at a +4.5R trade.

Quite interestingly though, the stock offers a second entry that has enough ingredients for us to add to our position. Stock has consolidated around that $176.42 level and prints a nice buy setup signal bar after failing to continue lower when trading below that red indecision candle. Even if you had taken profits or stopped yourself out around that area, you had another chance to re-enter.

Something that's worth keeping in mind when looking at these charts is that every decision you make throughout this trade is 5 minutes apart. 5 minutes is a lot of time. Personally, I come from a scalping background and that first consolidation at the $176.42 level still feels like an eternity if I'm in a trade.

This second trade is again quite stress-free, especially on the first leg into the low $180s. I'm not sure I'd hold through that healthy pullback, but my algo surely would as the stock never breaks the uptrend. Price never breaches the pivot stop marked with T3, which is conveniently located between two levels where price finds support and bounces back up to the ultimate $183.41 target.

Closing notes

If only it was this easy, right? Honestly, the trade entry, exits, and management is quite systematic. If you go back to previous posts, while there's sometimes some discretion, especially when deciding on the exits, I keep most of the entries and trade management pretty mechanical.

As I often say, if you're not profitable in your trading you either don't have an edge or are failing to respect it. We tend to sabotage ourselves as we struggle to navigate the emotional chaos that stems from the battle between our preconceived biases and whatever is happening in front of us. Your system is your armour. You can't fight without it. Use it.

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!

I love AMD!💕 She’s my favorite for understanding the basics.

Thanks Abel!