Nasdaq 100 (QQQ) - Feb 20th 2024

Capitalizing on the market pullback despite missing the initial drop

Higher timeframe context

Markets have been on an absolute tear for quite some time now. The whole AI theme has driven the markets to new highs with no rest. Are we due for a significant pullback?

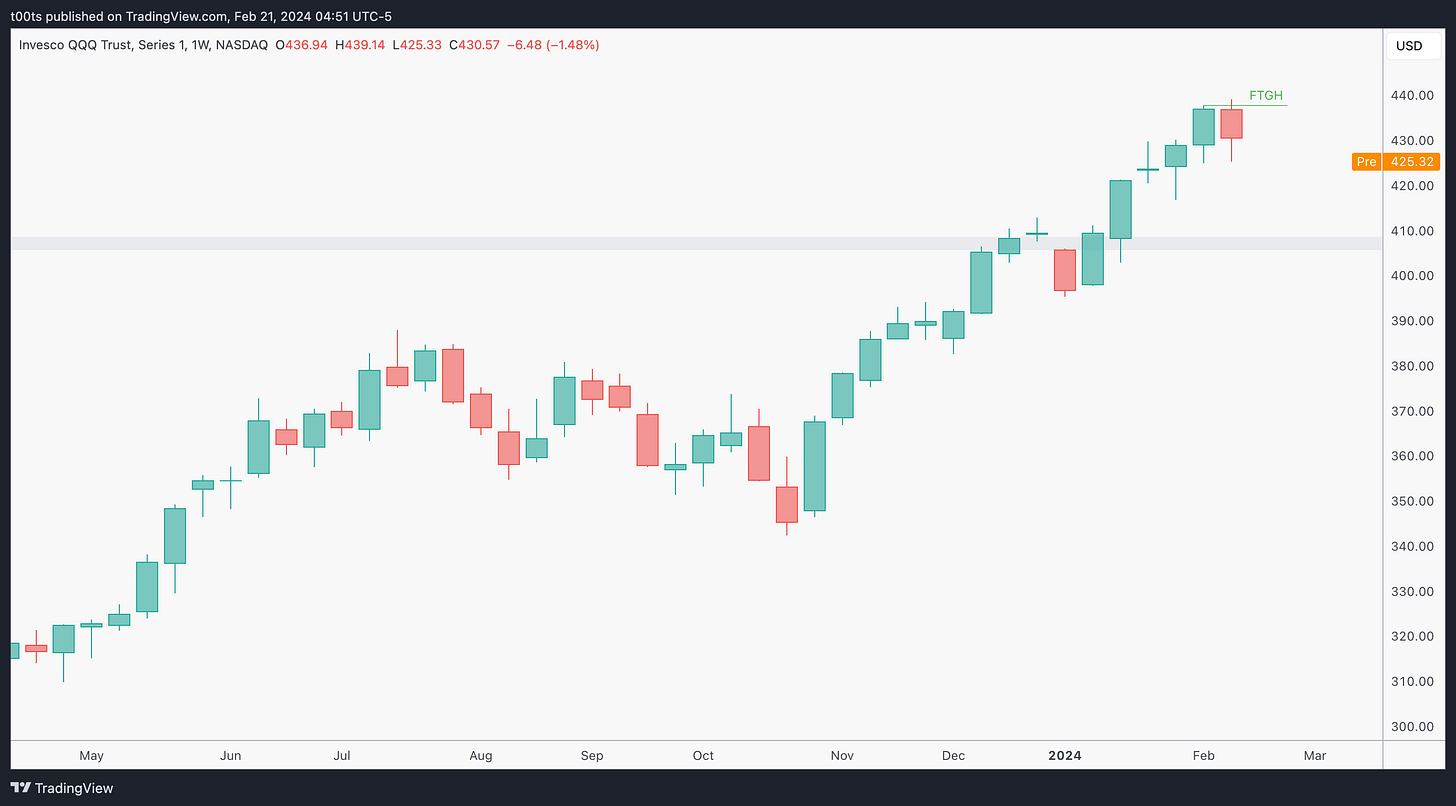

Weekly chart

Last week we had our first red week in a while after price traded above previous week highs and failed to hold. Given how much everyone is expecting a pullback, this is worth noting.

Daily chart

The daily chart might be curling and getting us ready for a pullback. Notice how last week's action was essentially price filling the CPI gap and then the turning back down, leaving us with a potential lower high. The $430 area seems like the line in the sand to keep things going to the upside.

Hourly chart

Here we get a little more detail on Friday's action. Bulls attempted the bounce at the $430s but sellers won the battle towards the close and managed to end the day at the lows, slightly above our line in the sand.

Pre-market action

This pre-market chart is already telling us a story and setting up a potential trade. The $430 psych. level didn't even trade yet. Price has been hovering below the key support area and so far is being rejected on every touch.

The trade

There's a solid opening drive trade to the downside which I never saw at the time as I had other stocks on watch. Regardless, I was able to catch a move later in the day that was so smooth it was hard to believe.

I'll be honest, now that I'm reviewing the action with more detail I feel pretty bad about missing that $430 short off the open. It looks like it had enough ingredients to be a good candidate for a trade.

Here's what my CPT looked like:

Cue(s)

Price gapping below key support into a new week

Strong rejection at our key inflection point straight off the open

Intraday cue: Names like AAPL, MSFT, NVDA showing weakness

Intraday cue: Strong failure of a buy setup after reclaiming the $426s

Intraday cue: Sell setup with small bar that allows for larger size

Plan

The moment the buy setup fails on that strong bearish trend bar and breaks back below the level, I'm looking for opportunities to short. At that point, AAPL and MSFT -two stocks I've been watching that day- have also rejected intraday levels.

I was more inclined to short MSFT, but the rejection was too strong, leaving me with little room to put size on. That sell setup on QQQ with a small bar allowed for a better risk-to-reward trade, so I went with it instead.

Trigger

Price trading below the signal bar

5m chart

It was fair game to attempt that long after the $425.98 level was reclaimed. In this market everything is possible. But what's interesting for us is that the setup failed, paving the way for a move lower.

The pullback to the level and that small bar rejecting off it seem too clean to be true. And most of the times these perfect setups aren't that easy later. I took the trade with a bit of skepticism, but the cues were there and the risk-to-reward was definitely worth it.

The trade worked almost immediately and was a relatively low-stress trade. I'm not particularly used to how QQQ moves and its premiums felt kind of volatile, but to my surprise, price went straight to target with no pullbacks. There's no 5m candle that trades above previous bar highs during the whole drop. That's how I measure stress.

2m chart

Here's a close-up of the action using the 2 minute chart. Notice there's just one 2 minute bar that traded above previous bar highs. Again, that's pretty low stress for me.

Closing notes

It seems like these late morning moves have been a theme lately. I'm honestly still amazed on how well this trade worked. I found this day to be full of traps and frankly experienced some relief when this one worked so well.

NVDA has earnings this week. After carrying the market for months, whatever they report will probably dictate where the market is heading next. Until then, stay safe!

I am posting one trade writeup every day throughout 2024. I focus on large caps using levels and price action. The subscription is absolutely free and will always be. I will strive to provide value by offering clues and ideas for you to enhance your edge. Let’s grow together!